Top Guidelines Of Nj Cash Buyers

Table of ContentsNj Cash Buyers Fundamentals ExplainedUnknown Facts About Nj Cash BuyersExcitement About Nj Cash BuyersNj Cash Buyers for Beginners

By paying money, you miss out on this tax obligation benefit. Having a home outright can leave you with limited fluid properties offered for emergency situations, unanticipated expenses, or other financial demands. Here are some compelling factors to consider getting a home mortgage as opposed to paying money for a residence:: By taking out a home loan, you have the ability to leverage your investment and possibly attain higher returns.

Rather than connecting up a significant amount of money in your home, you can maintain those funds offered for other investment opportunities - sell my house fast nj.: By not placing all your readily available cash money right into a solitary possession, you can maintain a more diversified investment portfolio. Profile diversification is an essential risk monitoring approach. Paying cash money for a home uses numerous benefits, boosting the portion of all-cash property offers

(https://www.anibookmark.com/user/njcashbuyers1.html)The cash acquisition house procedure requires binding a substantial section of fluid assets, potentially limiting financial investment diversification. On the other hand, getting a home mortgage permits leveraging financial investments, preserving liquidity, and potentially profiting from tax obligation advantages. Whether buying a residence or home mortgage, it is important to depend on a trustworthy property system such as Houzeo.

The Ultimate Guide To Nj Cash Buyers

With countless residential or commercial property listings, is one of the biggest residential or commercial property listing websites in the United States. Find condominiums, condominiums, co-ops, and other kinds of homes up for sale on Houzeo. Review these special Houzeo reviews and find out why the platform is the most effective in America's affordable housing market. Yes, you can purchase a residence with cash money, which is much less complex and helpful than making an application for home mortgages.

Paying money for a home locks up a large amount of your liquid assets, and limit your economic adaptability. In addition, you lose out on tax advantages from home mortgage interest reductions and the possibility to spend that money elsewhere for potentially higher returns. Professionals indicate that even if you have the money to get a property, you ought to secure a home mortgage for tax exemptions and much better liquidity.

Now that we have actually gone over the need for cash money offers in today's real estate market, let's discover what they are, that makes them, and their benefits for customers and vendors. Typically, the purchaser has the total sale amount in their bank account and acquisitions the residence with a check or cable transfer.

All-cash sales are coming to be increasingly preferred, accounting for nearly 40% of single-family home and condominium sales in Q2 2024, according to property data firm ATTOM. In 2023's seller's market, several purchasers had the ability to win proposals and save money on rate of interest thanks to pay offers. Cash deals typically cause a quicker closing process, which lures vendors to accept such bids.

Things about Nj Cash Buyers

Real estate capitalists might locate the purchase of rental residential or commercial properties with money to be appealing. Although this method uses its share of benefits and disadvantages, we will certainly examine them below to permit capitalists to make an enlightened choice concerning which course is ideal for them. Cash acquisitions of rental residential properties provide instantaneous equity without sustaining home mortgage payments, offering you instant ownership in addition to economic versatility for future investments and expenses.

Cash customers have a side when negotiating since vendors would instead work with those that can shut quickly without requiring backups to fund an acquisition (NJ CASH BUYERS). This could cause discounts or beneficial terms which boost profitability for a financial investment decision. Cash money customers do not need to bother with rate of interest changes and the possible repossession risks that come with leveraged investments, making money acquisitions feel safer throughout financial downturns

The Greatest Guide To Nj Cash Buyers

By paying money for a rental home acquisition, you are securing away funding that might or else have actually been released in other places and created greater returns. Getting with such large amounts limits liquidity and diversity in addition to prevents total portfolio growth. Cash customers typically ignore the advantages of utilizing other individuals's funds as home mortgages to raise financial investment returns tremendously quicker, which might delay wealth buildup tremendously without leveraged financial investments.

Cash money buyers might lose out on particular reductions that could injure total returns. A financial investment that includes designating considerable amounts of cash in the direction of one residential or commercial property could posture concentration risk if its efficiency suffers or unforeseen problems occur, offering higher stability and resilience throughout your profile of residential properties or possession classes.

There has constantly been a competitive benefit to making an all-cash offer, yet when mortgage prices are high, there's one more: Obtaining cash is costly, and paying for the home in complete assists you prevent the regular monthly obligation of mortgage repayments and interest. Even more people have actually taken this path in the last few years, with the percent of buyers making use of a home loan to acquire a home falling from 87 percent in 2021 to 80 percent in 2023, according to the National Organization of Realtors' latest Account of Home Purchasers and Vendors. Of course, the majority of Americans don't have thousands of thousands of bucks existing around waiting to be spent.

Even if you can manage to acquire a house in money, should you? Yes, it is possible and completely lawful to acquire a home in full, simply as you would certainly a smaller-ticket item like, claim, a coat.

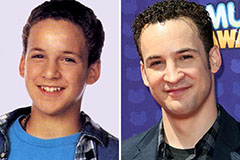

Ben Savage Then & Now!

Ben Savage Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Amanda Bearse Then & Now!

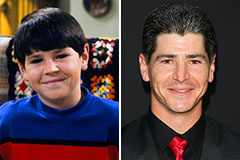

Amanda Bearse Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!